Contact us and we will help you select the relevant ITR ⇒

1.) WHAT IS ITR?

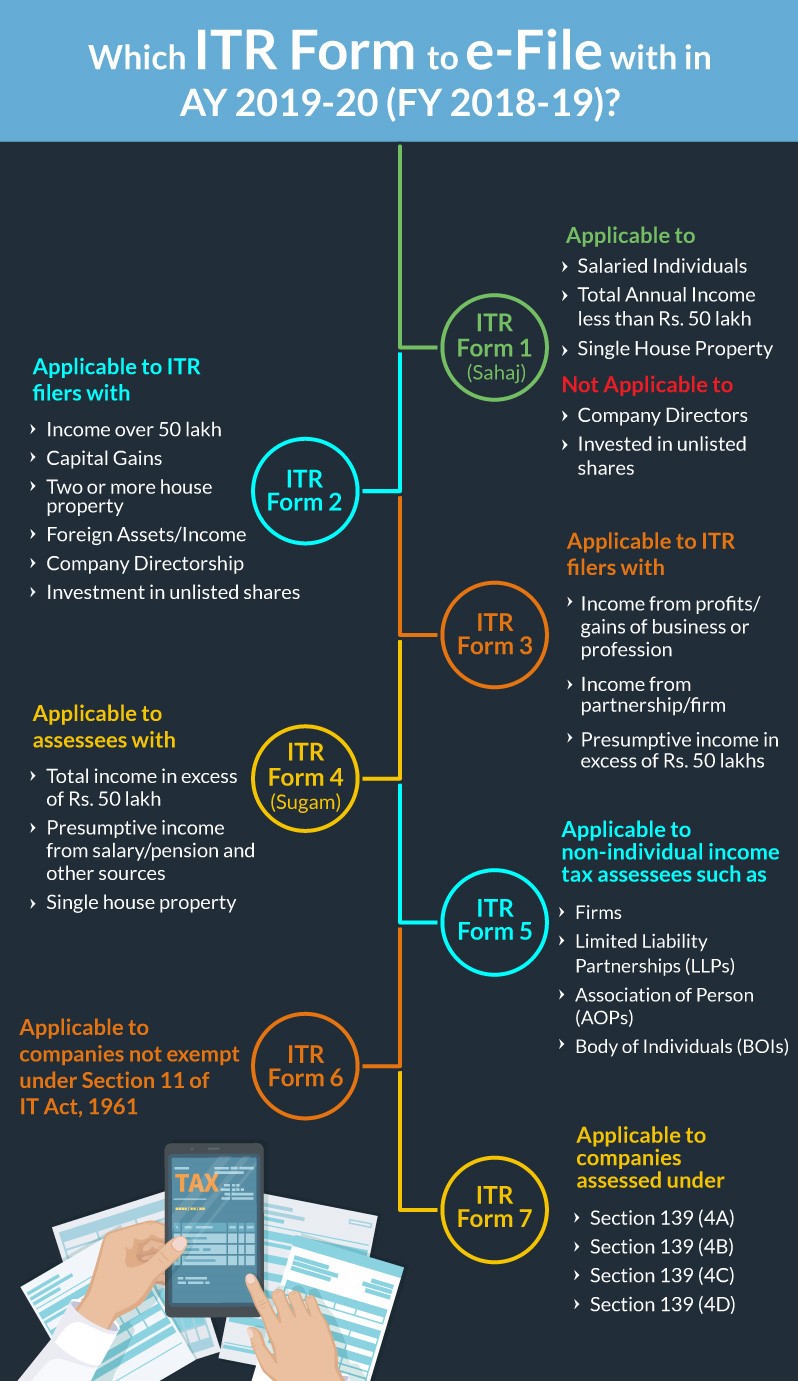

Income Tax Return (ITR) is a form in which the taxpayers file information about his income earned and tax applicable to the income tax department. The department has notified 7 various forms i.e. ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 & ITR 7 till date. Every taxpayer should file his ITR on or before the specified due date. The applicability of ITR forms varies depending on the sources of income of the taxpayer, the amount of the income earned and the category the taxpayer belongs to like Individuals, HUF, Company, etc.

2.) WHY YOU SHOULD FILE ITR?

It is mandatory to file income tax returns (ITR) in India if any of the conditions mentioned below are applicable to you:

1. If your gross annual income is more than-

Particulars | Amount |

| For individuals below 60 years | Rs 2.5 Lakh |

For individuals above 60 years but below 80 years | Rs 3.0 Lakh |

| For individuals above 80 years | Rs 5.0 Lakh |

2. In case you have more than one source of income like house property, capital gains etc.

3. If you want to claim an income tax refund from the department.

4. If you have earned from or have invested in foreign assets during the FY.

5. In case you wish to apply for visa or a loan

6. If the taxpayer is a company or a firm, irrespective of profit or loss.

3.) WHICH ITR TO FILE?

The following infographic will help you find out which type of Income Tax Return (ITR) return is applicable to you.

Once you figure out which ITR you need, click on the links below to begin filing your ITR.

Click on the links below to begin filing your ITR

ITR-7

For persons including companies required to furnish return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) or section 139(4E) or section 139(4F).

- Return under section 139(4A) is required to be filed by every person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes.

- Return under section 139(4B) is required to be filed by a political party if the total income without giving effect to the provisions of section 139A exceeds the maximum amount, not chargeable to income-tax.

- The Return under section 139(4C) is required to be filed by every –

- Scientific research association;

- News agency ;

- Association or institution referred to in section 10(23A);

- Institution referred to in section 10(23B);

- Fund or institution or university or other educational institution or any hospital or other medical institution.

- Return under section 139(4D) is required to be filed by every university, college or other institution, which is not required to furnish return of income or loss under any other provision of this section.

- Return under section 139(4E) must be filed by every business trust which is not required to furnish return of income or loss under any other provisions of this section.

- The Return under section 139(4F) must be filed by any investment fund referred to in section 115UB. It is not required to furnish return of income or loss under any other provisions of this section.